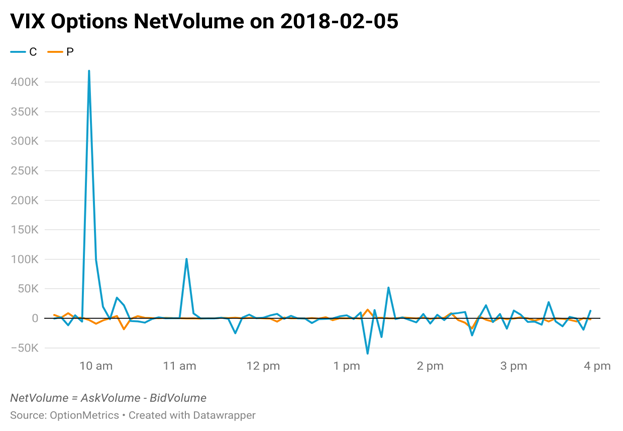

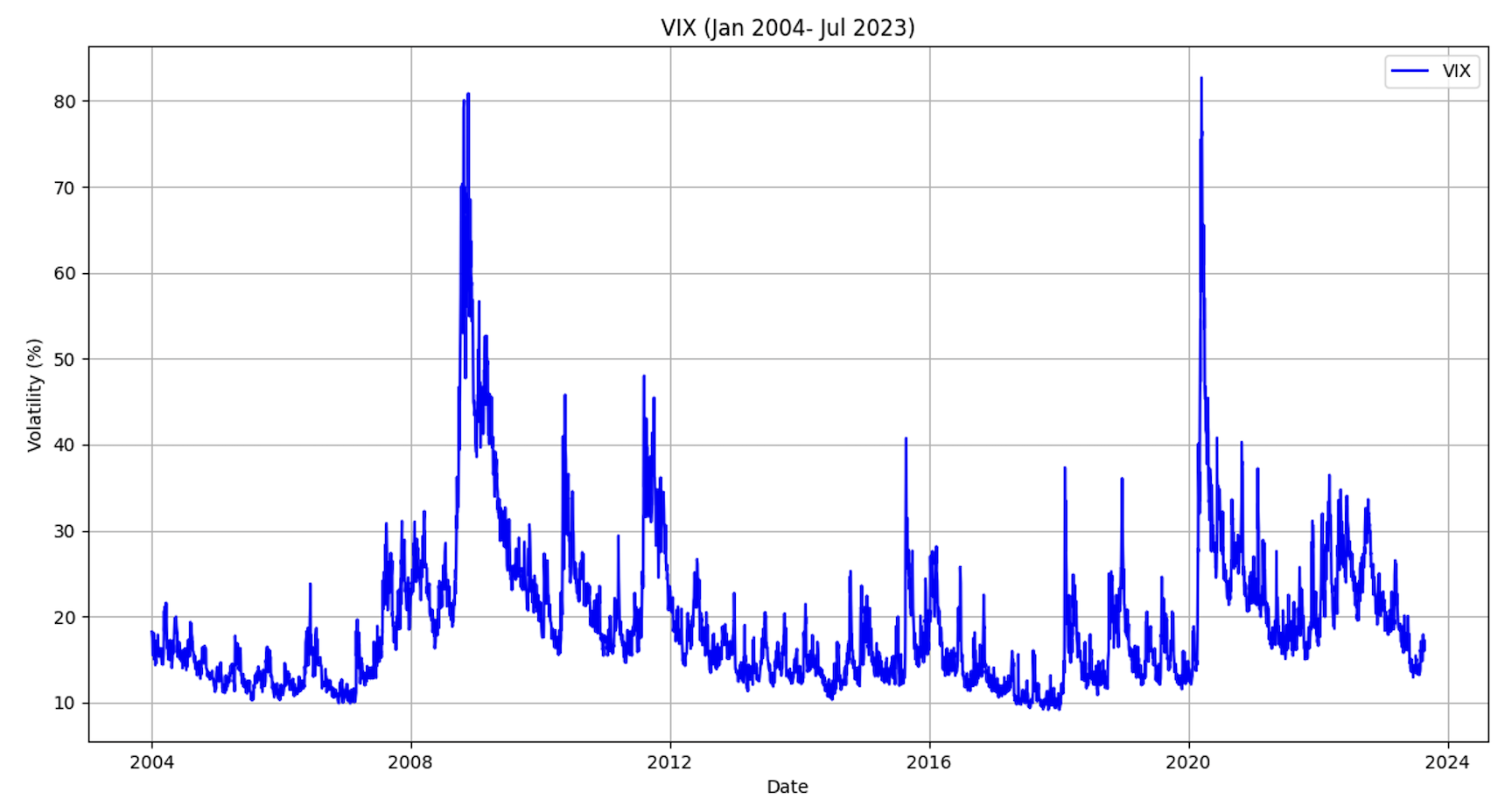

Volmageddon Unveiled: How Massive Options Trades May Have Enabled Historic VIX Spike

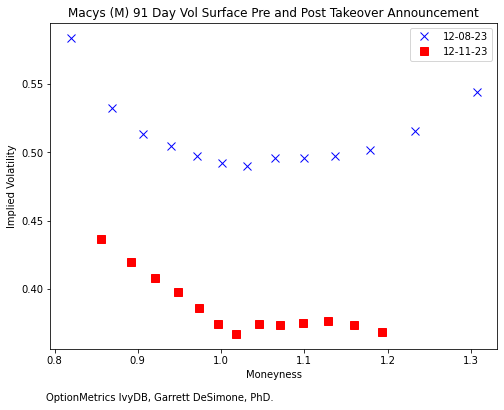

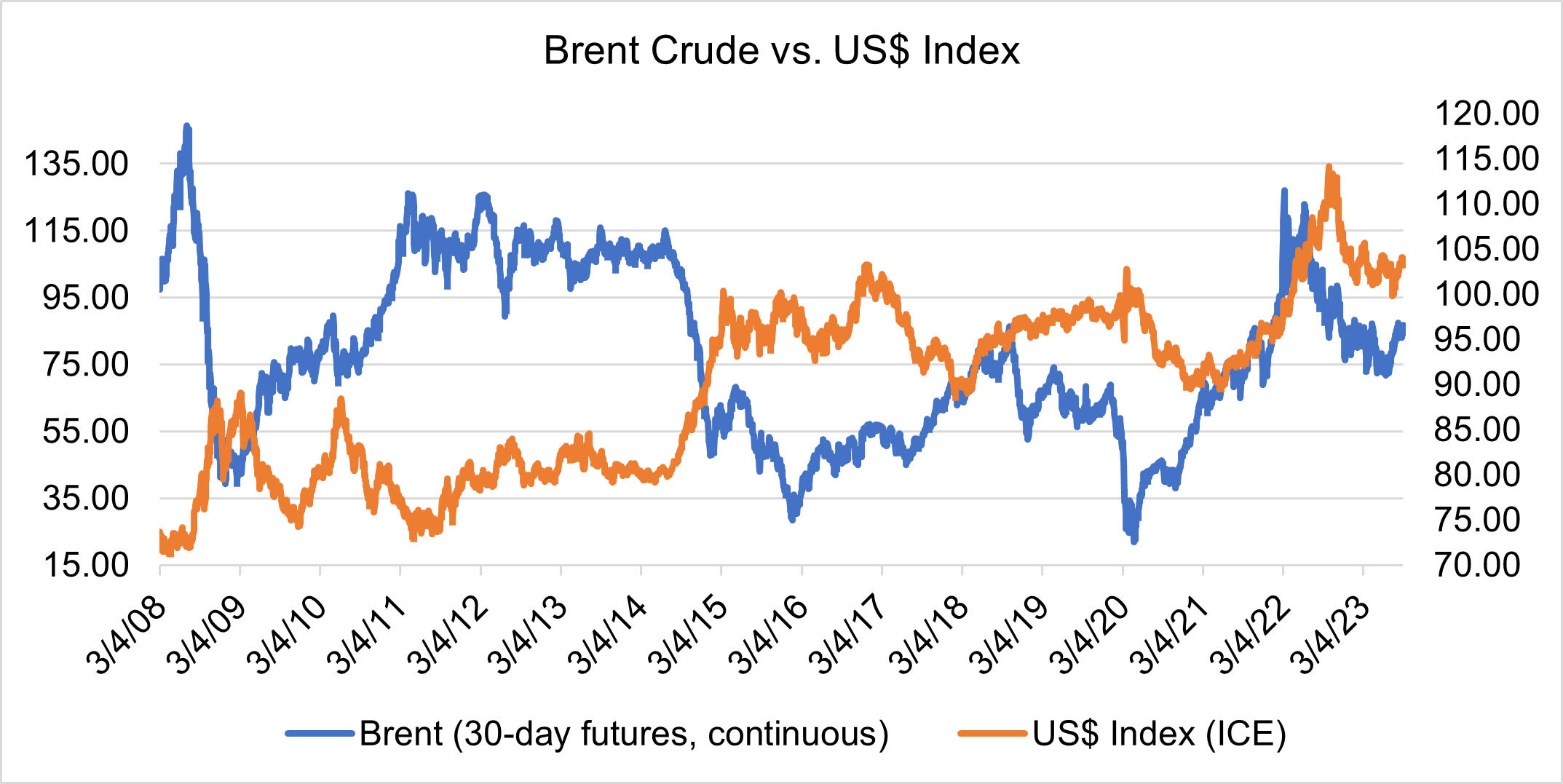

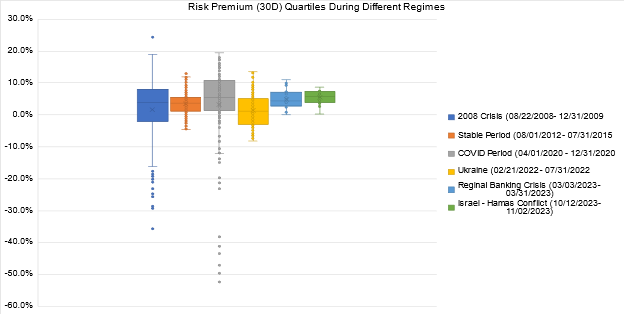

By: Garrett DeSimone, PhD & Oscar Shih Intro and background After 25 years in business, OptionMetrics has experienced many different markets and various volatility regimes. ...

Read more