By: Garrett DeSimone, PhD & Oscar Shih

Intro and background

After 25 years in business, OptionMetrics has experienced many different markets and various volatility regimes. In recognition, we look back at the single biggest daily increase of the VIX, commonly known as Volmageddon.

After an extended period of historically low market volatility, on February 5, 2018, the VIX surged over 100%, from 18 at the open to over 37 by market close. The most documented explanation is the overcrowding of the short volatility trade and the hedge rebalancing requirements of popular short VIX ETFs and ETPs. These products behave in such a way that issuers of short vol products require a short VIX futures position to remain market neutral, notably SVXY (ProShares Short VIX Short-Term Futures ETF) and XIV (VelocityShares Daily Inverse VIX Short Term ETN). To achieve this objective in a rising vol environment, traders needed to buy VIX futures contracts to match their short vol exposure after market hours on a daily basis.

The feedback effect that resulted is clear: during periods of rising volatility, these funds must continue purchasing VIX futures, thereby pushing up VIX prices. It was also probably clear to market participants on the morning of February 5th that these funds would have significant demand for VIX futures prior to the close.

Up until this point, we have not observed much discussion on the role of the VIX options market on this event.

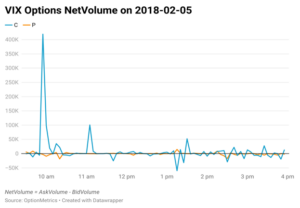

Our findings indicate that a highly abnormal volume occurred between 9:55 a.m. and 10:10 a.m. on the morning of February 5th, 2018. Utilizing the IvyDB Signed volume dataset, we uncover that over 400K net calls were purchased between 9:55 a.m. and 10:00 a.m., with a subsequent 100K purchased between 10:00 a.m. and 10:05 a.m. These trades carry significance due to both their magnitude and timing.

For context, over the previous two years, the median end-of-day total call buying in VIX options was approximately 427K. In other words, the VIX calls purchased in this 10-minute interval were greater than the typical amount of VIX calls purchased over the course of an entire trading day.

The timing is also crucially important. Between 9:55 a.m. and 10:05 a.m., the VIX level was near 19, representing only a small increase from the open of 18.44. The real acceleration of the VIX did not fully commence until the early afternoon, making these trades seem highly prescient.

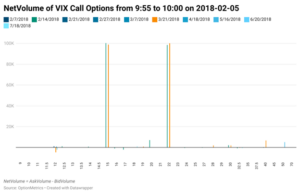

Next, we zoom in on the distribution of order flow across strikes and maturities during this 9:55 a.m. timestamp, presented in the graph below. It indicates that large buying pressure was dispersed fairly evenly across two strikes, 15 and 22, and two expirations, February 14th and March 21st. Therefore, these trades were directional bets on both the February VIX and March VIX future prices.

We argue that these massive trades likely played a part in the afternoon VIX surge. This is due to the negative gamma position market makers are exposed to on the opposing side of this trade. Short VIX calls are hedged with long VIX futures, which results in sustained futures buying when the VIX rises. Congruent to the “gamma effect” in equities, Huang et al. (2023) document that negative net gamma exposure of hedgers induces intraday momentum in the VIX market.

Therefore, market makers engaging in hedging would have needed to trade in the same direction as the VIX futures prior to market close to try to ensure they maintained delta-neutral positions. These traded call contracts represent a large abnormal imbalance that would need to be absorbed. While not entirely responsible, it is very likely that the large demand for calls in the early trading session of February 5th accelerated the VIX surge by the close.

As we reflect on these market events, OptionMetrics remains committed to providing insightful analysis and reliable data to help investors navigate the complexities of the financial markets. Here’s to another 25 years of innovation and growth!

Works Cited:

Augustin, Patrick, Ing-Haw Cheng, and Ludovic Van den Bergen. 2021. “Volmageddon and the Failure of Short Volatility Products.” Financial Analysts Journal 77 (3): 35-51.

Huang, Hong-Gia, Wei-Che Tsai, Pei-Shih Weng, and J. Jimmy Yang. “Intraday momentum in the VIX futures market.” Journal of Banking & Finance 148 (2023): 106746.