On Monday morning, Macy’s stock experienced a significant surge of over 20%, propelled by news of a potential buyout from two prominent hedge funds—Arkhouse Management and Brigade Capital Management. The proposed buyout, valued at $5.8 billion, offered shareholders an enticing 32% premium above the stock’s closing price on Friday.

The options market serves as a valuable indicator in assessing the likelihood of success in a merger and acquisition (M&A). Investors often participate in merger arbitrage, seeking to capitalize on the spread between the current stock price and the offered price. However, this strategy comes with inherent risks, as M&A deals can falter due to various factors such as regulatory hurdles or shareholder opposition. It parallels the risk profile of selling out-of-the-money (OTM) put options, which yield premiums but expose investors to substantial downside risk in the event of a deal collapse.

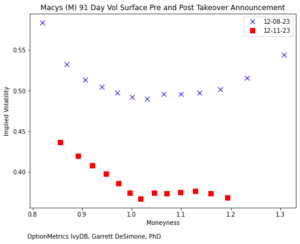

The configuration of the volatility surface carries crucial information about the probability of a successful merger. As outlined by Van Tassel (2016), in cash deals that prove successful, at-the-money (ATM) volatility tends to decrease, given that cash inherently possesses zero volatility. Additionally, the volatility surface exhibits a smile as out-of-the-money (OTM) put implied volatilities rise, reflecting the increased risk of a failed deal resulting in a significant price drop.

The following depicts the 91-day implied volatility (IV) surface for Macy’s before and after the takeover announcement. The chart vividly illustrates that post-announcement, ATM volatility has decreased, while the OTM put tail has become more pronounced. This reduction in volatility signifies a decrease in uncertainty regarding the buyout price. Conversely, if the options market perceived a low likelihood of the deal closing, the volatility curve would remain relatively unchanged.

In conclusion, Macy’s recent surge following news of a potential buyout reflects the market’s optimism about the deal’s success. The dynamics of the options market, specifically the volatility surface, offer valuable insights into investor sentiment and the perceived probability of a successful merger. The observed decrease in at-the-money volatility and the accentuated out-of-the-money put tail signify a reduced level of uncertainty surrounding the buyout price.

| Works Cited | |

| Van Tassel, Peter. “Merger options and risk arbitrage.” (2016). | |