Andres Hsiao | Quantitative Research Intern

Introduction & Key Findings

The US options market has grown tremendously over the past decade, becoming a massive force in global finance. But have other major markets around the world followed this trend? Utilizing data from IvyDB Europe and IvyDB Asia, we study how international options markets have evolved and whether they’ve kept pace with the American options market boom.

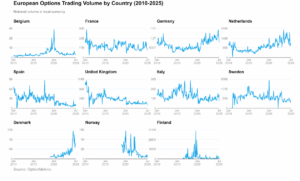

To assess these questions, we plot notional trading volumes per country, over the last 15 years, using OptionMetrics data. As you can see from the blue trading volume line plotted from January 2010 to July 2025 for each country in the tables below, it appears that European options markets tell a more subdued story over the past 15 years, compared to the U.S. The Netherlands and Denmark stand out as the growth winners, while Spain and the UK have been shrinking consistently. Germany went through a notable dip before climbing back to previous levels, and other major markets like France, Italy, and Belgium maintain steady levels with occasional spikes during market stress events.

Volume Trends

Total notional volume of options trading over time from 2010-2025, broken down by five major European markets: Belgium, France, Germany, Netherlands, and Spain. Each panel displays trading volume in local currency, giving us a clear picture of how European options markets have performed compared to their counterparts.

More specific observations include the following.

The Netherlands, Denmark, and Germany demonstrate strong growth in notional trading volume, showing a clear upward trajectory that distinguishes them from other European markets. Dutch volumes have risen in recent years, driven by steady retail participation, exchange-led innovation, and expanding single-stock option listings. Denmark’s option trading volume shows a dramatic upward trajectory that accelerates notably from 2020 onwards. This growth reflects the global derivatives trading boom during COVID-19 pandemic-driven retail investor enthusiasm.

Spain and the UK show contrasting decline patterns, with both markets experiencing significant decreases in option trading volume, though following different trajectories. Spain exhibits a more volatile decline with periodic spikes before settling into sustained low levels, while the UK demonstrates a more consistent downward trend from higher peaks in the mid-2010s to current modest volumes. Spain’s decline reflects structural challenges including limited new product development.

Belgium and France maintain relatively stable levels, though they experience periodic fluctuations that likely correspond to market stress events.

Open Interest Patterns

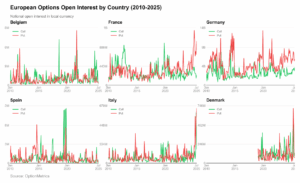

Notional open interest for calls (green) and puts (red) across the six selected European markets from 2010-2025. Open interest (OI) represents the total value of outstanding contracts that haven’t been closed or exercised, giving us a picture of how much money is tied up in options positions across different contract types.

Notable patterns from this analysis include the following.

Put open interest dominates call OI across all countries for most periods. This indicates that index products likely constitute a meaningful share of total options activity across these markets.

Several countries show notable spikes in overall options activity around 2020-2021, including Belgium, Spain, Italy, and Denmark, where both calls and puts increased simultaneously during this period. This reflects the general surge in options trading during the COVID-19 pandemic.

Maturity Structure Evolution

Open interest by expiration timeframe across selected European markets from 2010-2025, showing the percentage of total options positions that fall into specific maturity buckets – from weekly options (sage green) to long-term contracts (pink). Each colored line tracks how much of the market’s open interest sits in that particular time horizon, letting us see whether traders favor short-term or longer-term maturities.

Key insights from this data include the following.

Long-term options dominate in larger European markets, with the longer maturity buckets (pink lines) consistently making up substantial portions of total open interest in Belgium, France, and Germany in particular. This pattern reinforces the mature market characteristics we see across these established European exchanges.

The three Scandinavian countries show different patterns, with less stable term structure and seasonality compared to other European markets. Denmark, Norway, and Finland show more erratic fluctuations in their maturity distributions, with frequent shifts between short-term and long-term dominance rather than consistent seasonal patterns. This suggests smaller market size, higher retail participation, and less systematic institutional hedging compared to established derivatives centers.

European options markets tell a nuanced story from 2010-2025, with clear growth winners in the Netherlands and Denmark, notable activity surges during COVID-19, and distinct expiration patterns that reflect the divide between established institutional centers and emerging retail markets.

Analysis based on IvyDB Europe data from 2010-2025. All figures in local currency unless otherwise specified.