Garrett DeSimone, PhD, Head of Quant Research, OptionMetrics

Jeff Corrado, Director of Operations, Volos Portfolio Solutions

A covered call is a fundamental options strategy, employed by a wide range of investors, from retail investors, to those in embedded ETFs, pension funds and hedge funds. The appeal of this strategy lies in its simple structure–long stock combined with a short call. Covered calls can generate additional yield in the form of premium received for the sold call, while trading off upside potential.

While execution of this strategy is relatively straightforward, covered calls often have rich and complex risk exposures. Israelov and Neilsen (2015) note that covered calls should be understood as a strategy that combines long equity with short volatility risk exposures. Additionally, covered calls represent a low beta strategy as a result of negative beta embedded in the short call position.

Low beta, or more broadly low volatility strategies have gained popularity due to the fact that low-risk stocks have achieved higher risk adjusted returns. If stock beta is time-varying, it makes sense that the delta of the short call component should also vary. In order to reduce the beta of the overall strategy, the option position should increase in short call delta when beta is higher than average and reduce the short call delta when beta is lower than average.

We utilize the Volos Strategy Engine to build options strategies, and the implied betas in OptionMetrics IvyDB Beta to backtest covered call strategies with a dynamic call component to test this theory. Implied beta benefits from its ability to embed forward looking expectations of systematic risk from the option market.

We structure the benchmark covered call strategy as follows:

- Construct equal-weighted portfolio of Magnificent 7 stocks (AAPL, GOOGL, NFLX, NVDA, META, TSLA, AMZN).

- Sell a short ATM (at the money) call or 5% OTM (out of the money) call. The number of short calls is in proportion to the total number of underlying stock shares.

- On a weekly basis, roll each short call such that the new strike is ATM or 5% OTM.

We compare this against our Dynamic Implied Beta (IB) Covered Call strategy:

- Construct equal-weighted portfolio of Magnificent 7 stocks (AAPL, GOOGL, NFLX, NVDA, META, TSLA, AMZN).

- Calculate the trailing 50th percentile IB per stock over the last 252 days.

- If IB at time t is > 50th percentile IB, sell an ATM call (100 Moneyness).

- If IB at time t is < 50th percentile IB, sell a 5% OTM call (105 Moneyness).

- On a weekly basis, roll each short call with updated IB and updated trailing 50th percentile. Select new calls based on conditions in step 3 or 4.

Additionally, we horserace our IB signal against their historical beta (HB) analog. If implied beta is a better future predictor of realized beta, we should observe stronger performance of dynamic IB compared to dynamic HB.[1]

The intuition behind the dynamic IB strategy is to seek reduction in the overall beta of the position when the current implied beta is above its long-term median. This is achieved via an ATM short call. Alternatively, when beta is below its long-term median, the strategy increases its overall beta by selling an OTM call, with a smaller absolute delta.

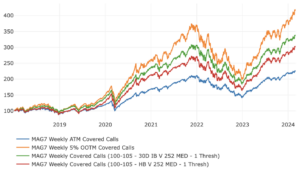

In the chart below, the Volos Strategy Engine generates backtest results, ranging from Jan 2018 – March 4th 2024.

Source: Volos Portfolio Solutions

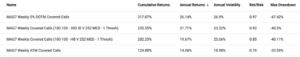

Inspecting the benchmark covered call strategies, we find significantly higher annual returns in the 5% OTM Covered Calls compared to ATM Covered Calls (26.14% vs. 14.06%). This result is straightforward given our selection of our security universe, which we acknowledge may be subject to some hindsight bias.[2] The MAG7 stocks have seen exponential growth over the last five years, which clearly favors option strategies with larger upside capture.

Next, we turn to MAG 7 Weekly Covered Calls (100-105 – 30D IB V 252 MED), i.e., Dynamic IB strategy, which utilizes implied beta as the signal. Our dynamic strategy generates meaningfully larger annual returns over its historical beta counterpart (200 bp difference) and ATM covered call strategy (670 bp difference).

From a risk/return perspective, the Dynamic IB strategy boasts a Sharpe ratio of 0.93, outperforming both Dynamic HB and the benchmark ATM strategies, which have Sharpe ratios of 0.85 and 0.74, respectively. Although the benchmark 5% OTM strategy exhibits a slightly higher Sharpe ratio, it also experiences a 7% larger drawdown compared to the Dynamic IB strategy, suggesting greater downside risk associated with the benchmark 5% OTM strategy.

In conclusion, covered call strategies can offer a straightforward way to boost portfolio yields, but they come with complex risk exposures, including low beta and short volatility due to short call positions. Recognizing the benefits of low beta strategies, we tested a dynamic covered call approach using implied beta signals. Backtesting revealed that the dynamic implied beta strategy outperformed both historical beta and traditional ATM covered call strategies in terms of annual returns and risk-adjusted performance. This suggests that incorporating implied beta signals can enhance the vanilla covered call strategy by scaling exposure to future beta risk.

[1] Historical beta estimates are formed on 252 day rolling daily returns. We tested other historical windows and found similar results.

[2] For historical context, Jim Cramer is credited for the FAANG acronym circa 2017, the predecessor to the Magnificent 7 sans Nvidia and Tesla. Given that this backtest begins in 2018, it is a reasonable assumption that an investor would select this basket of securities with the performance information available at that time.

Source

Israelov, Roni, and Lars N. Nielsen. “Covered call strategies: One fact and eight myths.” Financial Analysts Journal 70, no. 6 (2014): 23-31.

Bios

Garrett DeSimone, PhD, Head of Quant Research, OptionMetrics

Garrett DeSimone is the Head of Quantitative Research at OptionMetrics, LLC. Dr. DeSimone graduated with his Ph.D. in Financial Economics from the University of Delaware, where he served as an adjunct lecturer in finance and economics. He earned a M.S. in Economics and Applied Econometrics from the University of Delaware, and a B.S. in Mathematics from the University of Maryland-Baltimore County.

Jeff Corrado, Director of Operations, Volos Portfolio Solutions

Jeff Corrado is the Director of Operations at Volos. Jeff works directly with Volos’ clients to design customized passive and active investment strategies. Jeff is passionate about volatility & options structuring, small cap stocks, and alternative (and signal-based) investment data. Jeff has an undergraduate degree from the University of Southern California and an MBA from the F.W. Olin School of Business at Babson College. He is located in Boston.

Volos Portfolio Solutions

Volos Portfolio Solutions is an index and software provider with a specialty in options-based strategies. Volos’ Strategy Engine offers institutional investors, hedge funds, and ETF providers deep flexibility to design both basic passive and sophisticated active options strategies without the use of code. Volos’ Custom Strategy Platform allows users to analyze, monitor, and implement strategies built within the Engine through a wide host of analytics and visualizations that provide unprecedented visibility into what were previously opaque options strategies. Volos was founded in 2014 and is a Boston-based company.