Commodity futures were not immune to the main themes that moved markets in 2025. As usual, geopolitics, supply/demand factors, and domestic and international economic conditions were the most significant market drivers. However, one factor in particular – economic policy uncertainty – rose to unprecedented levels, leading to a general feeling of uneasiness about the future. This led directly to the most significant development in commodities in 2025, the inexorable rise of precious and industrial metals.

Precious and Industrial Metals

Precious metals dominated commodities in 2025 with some truly astounding gains (see table below). Although gold peaked on October 20th and briefly dipped under $4000, it has been slowly and steadily recovering since. At the same time, silver paused briefly and continues to make new highs. The fundamentals driving the rally in precious metals — inflation, uncertainty, and a generally dismal view of the future — might well continue into 2026.

Certain industrial commodities have increased even more than gold and silver. In general, these are niche commodities with limited volume and are not available to most retail investors. Sulfur, which is used primarily in fertilizer, is at all-time highs and registered the largest increase for any commodity in 2025. Industrial metals driven by automotive and battery demand have also shown significant increases.

One interesting aspect of gold that is only apparent to options traders: given all the press about how volatile it is, gold trades at unexpectedly low volatility levels. It’s annualized historical volatility spanning 10/03/2005 – 12/12/2025 was just 17.85%. By way of comparison, crude oil’s historical volatility over the same period was 40.70% and its implied volatility has gotten as high as almost 200%. In contrast, gold’s all-time highest implied volatility was only 62.30% during the 2008 financial crisis. Apparently, gold is not as volatile as popularly conceived, and considerably less volatile than some other commodities.

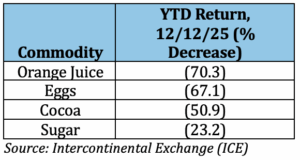

Agricultural Headliners Fade

Agricultural commodities in 2025 were dominated by commodities that are purchased directly by consumers – orange juice, eggs, sugar, cocoa – and therefore frequently make headlines. Not surprisingly, they have an outsized influence on inflationary expectations. Early in the year, eggs were in short supply and became the symbol of out-of-control inflation. After all the attention waned, they came off sharply and are currently down 67.1% YTD. Another example is orange juice, which made new all-time highs in October 2024 but is now over 70% lower. Although these commodities feature prominently in the public’s image of high volatility futures trading, in reality they represent just a small fraction of worldwide commodity volume.

Crude Oil – The Next Big Development?

Oil had a relatively uneventful 2025, but that may change soon. Caught between bullish geopolitical developments and bearish supply fundamentals, crude mostly continued its slow speed descent since September 2023 when futures peaked at $90.64 (WTI, 30-day continuous). Reflecting this, crude’s average implied volatility for 2024 and 2025 (32.1% and 28.9% respectively) has remained below its long-term average of 35.4%.

However, increased and realistic prospects for a resolution to the war in Ukraine are weighing on the market. Crude oil is testing the lows from mid-October and may eventually move to a lower trading range. Its current implied volatility of approximately 27.5% sits very near its lowest quintile (26.35%). Since crude oil implied volatility tends to spike when prices accelerate to the downside, sharply higher volatility is entirely possible.

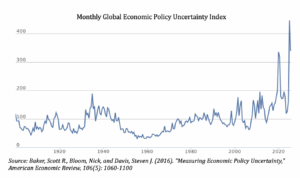

Uncertainty Rules

It is worth reiterating that economic and political uncertainty reached new all-time highs in 2025 and were a constant and disruptive influence to all markets, commodities included. The Monthly Global Economic Policy Uncertainty Index is constructed from three different components: the number of articles published on economic uncertainty, planned changes in federal tax code provisions, and the dispersion in forecasters’ predictions about future levels of the CPI, federal expenditures, and state and local expenditures.

Uncertainty has always been a feature of markets, but never to the extent it was in 2025. The index (see chart below) reached new all-time highs during the tariff-induced panic last April, making it higher than at any time including the pandemic, the 2008 financial crisis, both world wars, and the depression. Even allowing for methodological difficulties, it’s a significant finding that is constantly in the background and could be behind the steady stream of apocalyptic economic forecasts that seem to dominate social media.