Short term commodity price developments are in disagreement with longer term market-based forecasts. Although this is often the case, as markets are buffeted by short term events that aren’t necessarily related to long term factors, the current disparity seems glaringly large and has important implications. Two fundamentally based interpretations are possible.

In the first, factors such as ongoing and chronic geopolitical tensions, projections of faster economic growth, a strong US dollar, alternative energy investment, and supply constraints in certain commodities, are being cited for stable to higher commodity prices, with the potential for localized spikes, over the next few years. Reflecting these factors, commodity prices are still considerably higher than pre-pandemic levels. As measured by the two most popular indexes, the Goldman Sachs Commodity Total Return Index (GSCI) and Bloomberg Commodity Index (BCOM), commodity prices as of May 14 were 138% and 70% higher, respectively, from their lows of late April 2020 (which for BCOM was the lowest level since 1988); year-to-date, they are 8.5% and 4.5% higher. There is no denying that commodities have staged an impressive comeback.

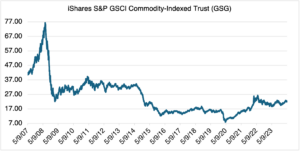

However, the high returns since 2020 and year-to-date are deceptive when viewed on a longer term, relative basis. This leads to the second interpretation. Although gains since 2020 have been impressive, recent performance over the last few months has been rather muted given the overwhelmingly favorable fundamentals. Most significantly, there are two conflicts in commodity-sensitive areas of the globe, both of which show little sign of ending anytime soon. And yet, with a few exceptions (copper, cocoa, and gold), commodity prices have not shown the long term upside progress that one would expect given the circumstances. Indeed, when viewed on a longer term basis, the rally since April 2020 is unimpressive, as represented by the iShares S&P GSCI Commodity-Indexed Trust ETF (which mimics the GSCI index):

Source: OptionMetrics

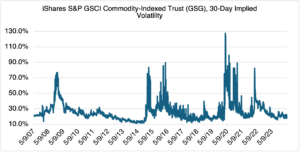

The implied volatility of GSG gives us insight into commodity markets that price alone cannot provide. Currently, 30-day implied volatility for GSG is below 20% and at the low end of its historical range (chart below). Since implied volatility is a measure of future price uncertainty, this indicates that the market is relatively complacent and not anticipating any major shocks in the short term.

Source: OptionMetrics

Apparently, the fundamentals are present, but the bull market seems to be lagging, at least in the short run. Of course, positive long term fundamentals do not necessarily equate to short term gains. However, weakness in the short term market should be concerning to those forecasting higher commodity prices on the back of continued geopolitical tensions. As I described in my last article (Crude Oil: Implied Volatility and Geopolitical Events), the premium resulting from geopolitical tensions, as measured by implied volatility, is decreasing as the two main sources of anxiety, the conflicts in the Middle East and Ukraine, drag on without significant supply disruption. As indicated by the low levels of implied volatility, the market has grown complacent, rightly or wrongly, that the status quo will continue. If it does, or relative peace somehow returns, then the geopolitical tension prop to the market will continue to lose effectiveness or may even disappear entirely. The geopolitical put, as it were, will lose value. The possible result could then be decreasing to stable short term commodity prices, which will likely deflate the medium to long term forecasts. Since commodity prices are directly tied to inflation, and to a lesser extent, domestic and global growth, this scenario could aid the Fed’s fight against inflation as well as the argument for cutting interest rates.

Of course, the opposite could occur as well, as current geopolitical tensions grow more acute or new and unexpected conflicts emerge. Short term prices, and the implied volatility of the indexes and its components, would then spike to match the new levels of uncertainty. Alternatively, short term commodity markets are just being slow to react and will eventually catch up with bullish long term forecasts. Currently, however, the lack of consistent upside progress in commodity prices, despite ongoing and serious geopolitical tensions, should be of concern to those waiting for these scenarios to unfold.