Last week marked the one year anniversary of the start of the war in Ukraine, and the ultimate outcome is as unclear as it was a year ago. War is never predictable (as Mike Tyson put it, “Everybody has a plan until they get punched in the mouth”), and the market effects from the Russian-Ukrainian War have been no exception. Few involved at the beginning of the war would have predicted the wild, and surprising, ride that markets, and in particular, commodities, have taken. Their story provides useful lessons on how markets react to stress and supposed “Black Swan” events.

The beginning of the war was a genuine shock to the system, despite the months of saber rattling and threats that preceded it. Unpredicted shocks, such as Covid, produce the most significant and violent movements in inter and intraday price and volatility. Why is this? This is likely because of two reasons:

- Traders and risk managers considered the event to be of such low probability that its cost of mitigation wasn’t worth it. After all, we don’t wear hard hats outside to protect against random meteorite strikes! Identifying risks without taking into account the cost of their mitigation can be an exercise in hysteria without any useful results.

- They didn’t imagine the event in the first place, or it was just so far out there that it wasn’t worth considering. A “failure of imagination,” the oft quoted root cause of many unpredicted disasters, applies here. The phrase “Black Swan” (overused, and rarely accurately) also applies.

Whatever our innate and hard-coded reaction to unpredicted events, the result is that markets tend to initially overreact in a violent, knee-jerk fashion. However, often underestimated is the tendency for markets and complex systems to adapt to the situation, and faster than most would expect. The so-called “Y2K Bug” is instructive here. The fear that computer systems would be unable to read the year 2000 led to widespread and well-publicized predictions that anything associated with software would be inoperable. After two years of preparation and an estimated $300 billion in worldwide spending to fix the problem, the year 2000 dawned with no reported problems. The system adapted.

Markets display the same adaptive behavior and the reaction of the commodity markets to the war is a great example. As you may recall, commodity prices spiked across the board at the very beginning of the war but soon moderated. Tellingly, implied volatility levels increased but not to the extent that daily price ranges or swings predicted. I reviewed the war’s initial effects on commodity prices and volatility in a blog last March: War and Volatility: It’s Not That Clear. As I wrote, “…the long-term effects [of the war] are not as drastic as one might think… its effect on implied volatility has not been that impressive.”

By last June, commodity prices and volatilities had moderated to an even greater extent. In Inflation: Don’t Buy the High!, I argued that, with the exception of natural gas, “…the war is no longer supplying the physical and psychological shocks necessary to maintain the commodity rally.” As such, commodities were (and still are) mitigating inflationary pressure.

Currently, the commodities most affected by the war (energy and agriculturals) are at levels well below those that prevailed when the war began last March, something that very few would have predicted at the start of the war.

Let’s begin with the energy complex:

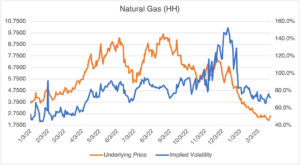

Source: OptionMetrics

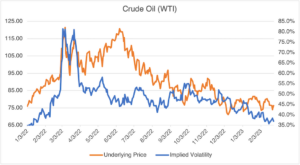

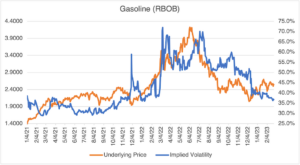

The largest and most unexpected post-war swing in prices and volatility belongs to natural gas. Russia’s European gas embargo has had the opposite effect of its intent. In the face of a slow-motion energy crisis last Fall, Europeans were forced to find new supplies (US LNG). Coupled with a mild winter, natural gas is currently 74% below its highs made last August 2022. Similarly, its implied volatility is currently about 72%, 82 vol points lower from its peak of almost 153% reached last December 12. Crude Oil and Gasoline tell a similar story of steep declines. For now, at least, it seems that the war is no longer propping up energy markets.

Source: OptionMetrics

Source: OptionMetrics

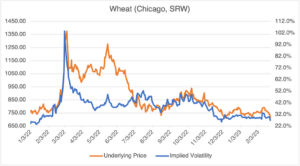

Since Ukraine supplies about 10% of the world’s wheat and 15% of its corn, the war had the potential to produce a significant and long term supply shock. Similar to the energy complex, prices and volatilities for both wheat and corn have declined significantly since the beginning of the war, as the worst supply projections failed to materialize. Again, a surprising result.

Source: OptionMetrics

Source: OptionMetrics

As discussed above, unpredicted shocks that no one is prepared for and out of the mainstream tend to have the most effect on markets. What are the possible candidates over the next few months? One possibility: a ceasefire, secretly negotiated, news of which is released without prior warning. Although, at this point, a low probability/high impact risk factor, remember the “failure of imagination” warning.