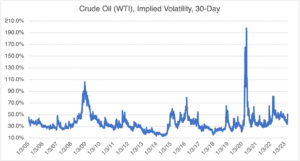

The recent spikes in implied volatility due to the fallout from SVB were not just confined to equity and fixed income. Less reported on and less appreciated, commodities were affected as well. Although their movements in price and implied volatility were certainly less dramatic, they were significant nevertheless, and indicated that the crisis was serious enough to involve asset classes whose fundamentals were affected only indirectly. As usual during severe crises, uncertainty was the main determinant of price and implied volatility and the individual characteristics of the specific instruments became a secondary consideration. In other words, traders were trading uncertainty.

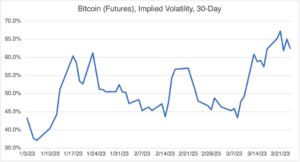

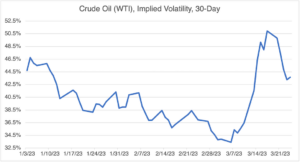

Two commodities in particular displayed this effect: gold and crude oil. For gold bugs, SVB called into question the soundness of the financial system and fiat currencies, two of their most core beliefs. Consequently, the metal was propelled to over $2000 and was seemingly in reach of its all-time high of $2075.14 from August 2020. The same held true for crypto currencies, namely bitcoin, which surged to new highs over $28,000. Although both commodities were in mildly bullish uptrends before the SVB crisis, both were reacting primarily to the uncertainty and extreme volatility in the fixed income market. Similarly, both factors, as well as increased prospects for a recession, negatively affected crude oil and drove it to new YTD lows below $67.

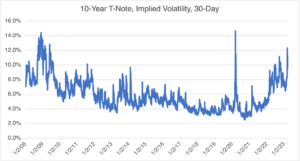

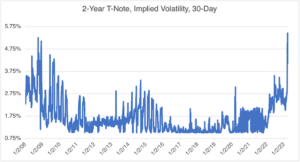

As mentioned, the primary driver behind the moves in gold, bitcoin, and crude was the extreme swings and uncertainty present in the fixed income markets. Implied volatility reacts the most to extreme and unanticipated shocks that seemingly come out of nowhere. The SVB crisis certainly fit the bill and caused volatility increases and acceleration not seen since the height of Covid, or even 2008 for that matter. Even commodity traders used to extreme volatility swings were impressed by what went on in fixed income volatility (see below):

Source: OptionMetrics

Source: OptionMetrics

Whether the effect of SVB was disproportionate to the crisis’ true potential, and whether the effect of financial crises are increasing in severity since 2000, is an interesting question for an upcoming article.

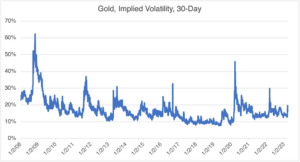

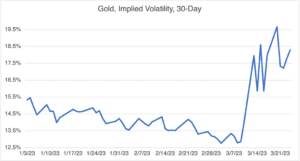

The explosion in fixed income volatility flowed through to gold and bitcoin, both of which showed more muted increases. For both, the prospect of new highs confirming the severity and breadth of the banking crisis added extra fuel to the increases. Although not nearly as impressive and historical as the moves in fixed income, they are still significant when viewed on a YTD basis. All have retreated somewhat as the SVB crisis has subsided.

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics