Regional bank stocks have experienced a significant decline in response to a series of recent failures, which has understandably raised concerns about the industry’s stability. This downward trend has been further fueled by substantial short selling pressures. Consequently, contagion fears have triggered significant volatility and trading volume in stocks like PacWest BanCorp (PACW).

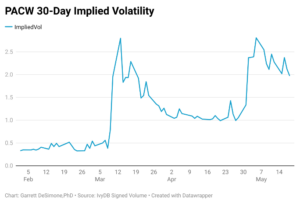

The chart below illustrates the 30-day ATM volatility associated with PACW options:

Given the heightened risk of ongoing bank runs and the surge in short interest, the risk profile of PACW has undeniably increased. The failure of Silicon Valley Bank, for instance, resulted in implied volatility peaking at nearly 300%, although it has since subsided to around 200%. These extraordinary levels of volatility indicate an exorbitantly expensive cost of engaging in option wagers.

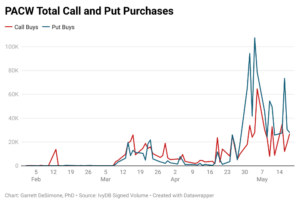

Elevated volatility can also be attributed to increased put buying activity by option traders. Chart 2 depicts the rolling average of total put and call buying specifically related to PACW, sourced from IvyDB Signed Volume. Today’s total option activity exceeds that seen prior to the failure of Silicon Valley Bank by nearly tenfold.

This surge in volume activity and volatility also suggests the possibility of a reinforcing short squeeze. Should any positive news prompt investors to engage in long call buying, it would inevitably lead to an influx of stock buying and a rush to cover short positions on a large scale.