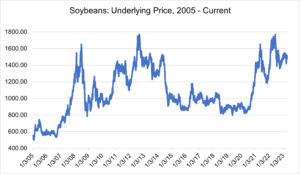

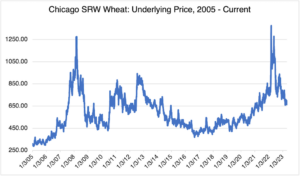

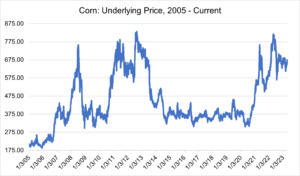

In the early days of the war in Ukraine, commodities in the energy and agriculture sectors displayed the most significant shocks. This was not surprising: Ukraine is a major global supplier of wheat, corn, soybeans, and barley, with an estimated 70% of its land devoted to farmland. At the time, the country supplied 15% of the corn market and 10% of the global supply of wheat, making them the 6th and 7th largest supplier of corn and wheat, respectively, worldwide. Early in the war, the Russian blockade of Black Sea ports, as well as predictions of mass destruction, led to fears of shortages, especially in Africa and Asia, and caused cereal and soybean prices and volatilities to spike. Wheat, corn, and soybeans all reached levels not seen since 2008, with wheat surpassing its 1975 all-time record high (see long-term charts below). Apocalyptic predictions of mass starvation, malnutrition, and sharply higher food prices fueling inflation dominated the press.

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

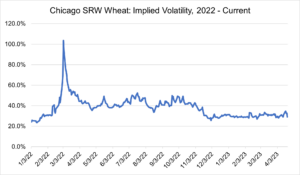

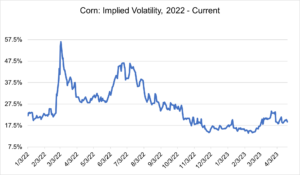

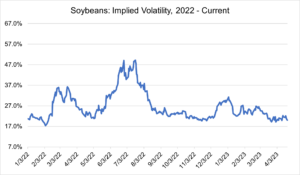

Luckily, the most dire predictions did not come to pass. Surplus goods from the rest of the world, as well as robust harvests in Ukraine and Russia and a deal to open the Black Sea ports, allowed wheat, corn, and soybean prices to fall to pre-war levels. Implied volatility levels, offering insights into the market’s view of potential future price fluctuations and uncertainty, have fallen similarly (see charts below):

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

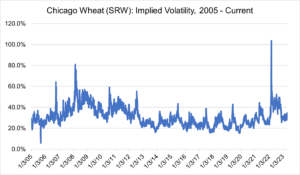

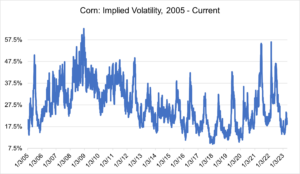

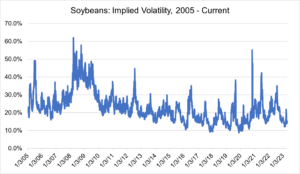

Both price and implied volatility levels suggest that war-induced uncertainty is fading and the market is no longer taking war news as seriously as it once did. However, long term implied volatility histories (see charts below) indicate that the market’s complacency with the situation may be overdone and premature:

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

As is apparent from the longer-term charts, consistent spikes in implied volatility due to annual crop cycles and geopolitical events are a feature of these markets. In the current situation, two factors may cause sudden and unexpected price and volatility shocks. First, Russian threats to terminate the agreement that allow the export of grains through Black Sea ports are a reminder that the war is still “hot” and subject to unpredictable swings. Second, and also war-related, this year’s grain harvests in the region are forecast to be down as much as 50% from pre-war levels. Current relatively low implied volatility and price levels seem to be ignoring these factors and may, therefore, be unsustainable.