Meme stocks are truly a phenomenon to behold. At their inception, many of these stocks—such as GameStop and Blackberry—were purchased by organized retail traders across social media platforms that had high short interest, which in turn created a squeeze that sent prices into the stratosphere. These short squeezes arise from supply and demand imbalances, as news triggers a price increase (or organized buying), shorts must cover their positions by purchasing the stock, supporting continued price ascensions.

Shorting is not free. It involves borrowing a stock that an investor does not own and paying a fee, or borrow rate, which is expressed as an annual percentage. For liquid securities, these fees are low, averaging about 0.25%. However, stocks with significant short interest can become hard-to-borrow (HTB) or nearly impossible-to-borrow (ITB) with rates exceeding 25% for some annually.

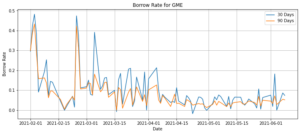

Implied borrow costs reflect the market makers’ costs of shorting in the option market. OptionMetrics calculates the borrow rate, which represents the costs of shorting across various horizons, across maturities. The table below plots the standardized 30 and 90 day borrow rates for the premier meme stock, GameStop (GME).

Source: OptionMetrics

During early February, GME was ITB with a rate near 50%. This was a result of the squeeze put on the stock by retail traders. However, since April borrow rates have stabilized near 5%, for the most part. This is consistent with increased liquidity by way of market makers’ adjustment in options prices.

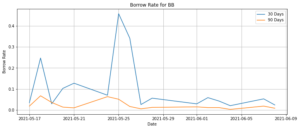

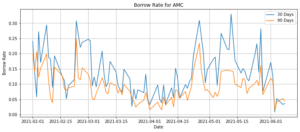

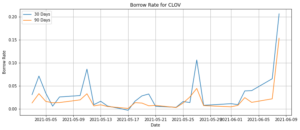

This notion is supported by data on borrow rates of other popular meme stocks such as Blackberry (BB), AMC Entertainment (AMC), and, most recently, Clover Health (CLOV), as shown respectively in the tables below.

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

As demonstrated in the charts above, meme stocks have become much cheaper to short. The stabilization of borrow rates supports the thesis that short squeezes have become less of a factor in meme stock rallies during June. This is a consequence of market adjustment – options dealers have become better at identifying retail behavior and pricing options accordingly.

Our research has identified two consistent themes regarding borrow rates and retail behavior.

- Spikes in borrow rate are typically accompanied by extremely high risk and subsequent crashes. This is apparent in GME following recent highs of $483 in late January and can be found in several prior AMC price cycles as well.

- Spikes in borrow rate can result in extreme overpricing of options, especially in the out-of-the-money call space. AMC implied volatility levels have exceeded over 300%, for instance. For reference, this means a 50 dollar AMC stock is expected to range between 7 dollars and 97 dollars with 63% probability over the next month. Exorbitant prices such as these are reflective of what retail traders have become willing to pay for “lotto ticket” bets that have extremely low likelihood of profitability.

To learn more about OptionMetrics’ latest product, IvyDB Borrow Rate, please contact info@optionmetrics.com.

Garrett DeSimone, PhD is Head of Quantitative Research and Abhinav Gupta is a Quantitative Researcher at OptionMetrics, LLC. Their company is options database and analytics provider for institutional and retail investors and academic researchers that has covered every U.S. strike and expiration option on over 10,000 underlying stocks and indices since 1996. It is online at www.optionmetrics.com.