Bitcoin has been heavily touted by its supporters as an inflation hedge. The logic behind this claim is that the number of Bitcoins is fixed, unlike with the U.S. money supply, which is subject to continued pumping by the Federal Reserve. This has led Bitcoin (BTC) investors to draw comparisons to gold, both serving as a long-term store of value.

The inflation narrative is only a small piece of the story when it comes to understanding BTC performance. Topped off by the Evergrande debacle out of China (with China’s second-largest property developer alerting banks it would not be able to make debt payments earlier this month resulting in a stock sell-off), BTC has become susceptible to broader macroeconomic risks. These also include uncertainty in U.S. aggregate output, monetary policy, and geopolitical developments. This means that BTC isn’t necessarily a hedge for inflation, but a risk-on asset for economic growth.

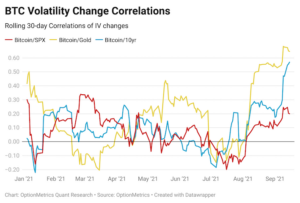

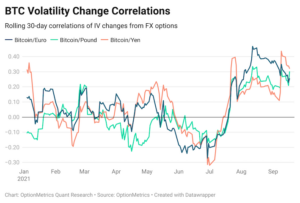

This recent paradigm is reflected in the correlations in implied volatility (IV) changes between BTC futures options and major asset classes beginning this year. Implied volatility is the options market’s expectation of future volatility of an asset. IV benefits from being a forward-looking measure; it encompasses investor fears regarding fundamentals.

Graph 1 displays the IV from CME listed BTC futures options. What should not be surprising to enthusiasts is that BTC can experience extremely high levels of volatility. Most notably this occurred during the March 2020 pandemic selloff and the in early 2021 BTC melt up.

Our main variable of interest is the relationship between BTC changes in volatility compared to changes in volatility of other asset classes. If volatilities increase together (positive correlation), it can represent a common factor driving investor fear, translated into option premiums across assets. While correlation does not necessarily imply causation, we can make the safe assumption that the size of the crypto market does not have the weight to influence US bond and commodities quite yet. We can categorize this fear as broadly related to economic news, since this news directly impacts foreign exchange, commodities, and rates.

Graph 2 displays the 30-day IV change correlation between BTC and the SPX, Gold, and U.S. 10-year treasuries. At the start of August, correlation levels on BTC/Gold and BTC/10yr began rapidly rising to current levels of 0.60. This high level of correlation indicates that volatility movements now flow in the same direction and signals that the same element causing uncertainty in rates and gold has also permeated to the crypto market. Interestingly, BTC vol has not shown much sensitivity to equity volatility in 2021, lending some credence to the notion that BTC volatility is uncorrelated to equities.

Graph 3 documents IV correlation changes between BTC and major currency pairs (Euro, Pound, Yen). The story is very similar; currency volatilities and BTC volatilities began moving closely in sync at the beginning of August, providing additional leverage to the idea that macro forces influencing FX (interest rate differentials, inflation, balance of trade) have also become a consideration for BTC investors.

BTC’s exposure to macro risk is an interesting predicament for crypto investors. If BTC truly becomes a cyclical economic asset, it loses a significant portion of alleged diversification benefits. On the other hand, greater exposure to macro risk is likely to reduce its volatility, which is extinguishing a trait investors love most about the digital currency.