Upcoming Tesla (TSLA) earnings announcements tend to get investors going. With TSLA stock frequently a source of investor disagreement, company news can violently push prices around. One source of this volatility is gamma positioning, or market maker inventory of short-dated call and put options exposure.

Gamma exposure has a natural connection to post-earnings volatility. Gamma, in the options world, is the second derivative of the options price with respect to a change in the underlying. Surprise earnings news can trigger jumps in stock price, resulting in gamma sensitive options experiencing significant gains.

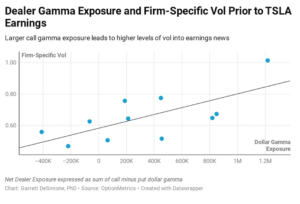

Unlike with investors in index options, market makers are concerned with negative and positive price jumps, since they provide significant liquidity to investors in out-of-the-money call space. The graph below demonstrates the strong relationship between gamma exposure (calls – puts) and firm-specific vol prior to TSLA earnings over the last three years. This vol isolates the “price” charged by market makers ahead of earnings news. As dealers become more exposed to call gamma, option premiums become more expensive.

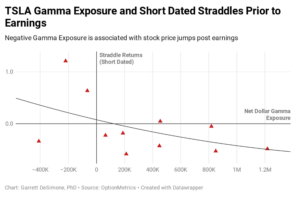

Short-dated straddles are sensitive to gamma or “jump” risk. This strategy profits from sudden jumps in the underlying stock price. Since these options are so close to expiration, there is much less relative time value embedded in their prices.

Our research, in the graph below, displays triangles that indicate straddle returns following earnings news, fitted to a quadratic function. Positive gamma suppresses straddle returns and leads to lower realized volatility following earnings news. On the other hand, when dealer exposure is negative gamma, straddles have extreme positive returns, and higher realized volatility. In other words, positive dealer gamma implies an overpricing of earnings vol, benefiting short volatility trades.

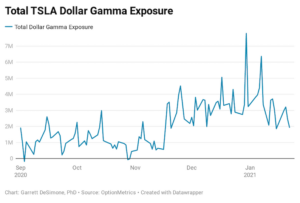

Gamma exposure going into TSLA’s 01/27 earnings is heavily positive, nearing $2M. This signals that volatility may compress following the news, causing loses in long vol positions. It is also an indicator that the current implied move of 9.6% is likely an overestimation of TSLA stock’s post earnings move. Simply put, a large call gamma inventory has exaggerated how much the stock will likely actually return, luring investors in at the price of a hefty vol premium.