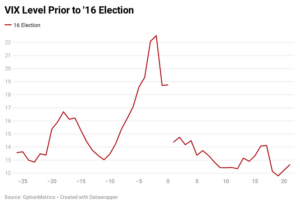

The volatility complex has clearly priced the 2020 Presidential Election as a major risk event. Speculation on contested elections, a blue senate flip, and another stimulus agreement have made hedging November volatility a pricey endeavor. This is captured by the backwardation of the VIX curve between the November and December contracts.

This abnormal shape of the VIX term structure indicates that there is a larger premium for insuring against short-term variance relative to longer term variance. For the opportunistic investor, the negative slope of VIX futures is a profitable signal for a short volatility trade. This is due to short-term volatility risk likely being exaggerated, and the election resolution likely producing a collapse in the November VIX contract as a result.

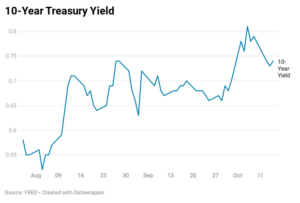

Bonds

In addition to a shift in executive control, a looming prospect of a blue takeover appears to have crept up in bond markets. There is an upward inflection in yield starting at the onset of October, which coincides with Democrats growing margins in both congressional and presidential national polls. Unified control of government provides an easier route to stimulus spending and deficit expansion, leading to higher yields a la crowding out.

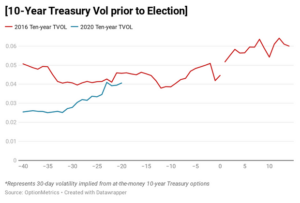

Treasury Volatility

Treasury volatility and equity volatility go hand-in-hand. Although, my stance has been that treasury vol is in the driver’s seat. Real economic shocks are more easily understood through changes in yields, which permeate through to equity vol. However, a unified government could create a short-term change in this dynamic. Resolution of the election winner will likely produce a drop in equity vol, coinciding with a reduction in macro risks due to a smooth transition in power. However, a blue congressional takeover provides fresh uncertainty regarding the size of infrastructure and stimulus spending. This would be consistent with the 2016 Election, in which both congress and the presidency surprisingly wound up in Republican control. The result in the bond market was an increase in 10-year yields and volatility.

While short equity vol is likely to be profitable, the election could also present a rare opportunity for a long rates vol trade.

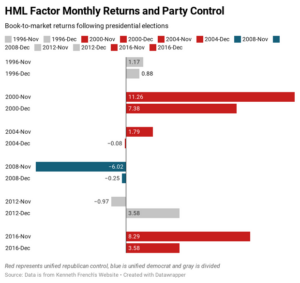

Growth and Value

Value performance, not great! However, this election may provide value investors some much needed reprieve. The returns to value are tied in to the yield curve environment. A steepening yield curve is often viewed as beneficial to the value sector. As hinted at above, unified government may be the catalyst to a steepening of that curve. The graph below demonstrates that in the elections of Nov ‘00 and November ’16 the High Minus Low (HML) factor, measuring the outperformance of value stocks over growth stocks, posted fantastic months. These were both elections in which executive leadership had changed. Incumbent election winners had no profound effect, as these were likely interpreted by markets as having minimal impact on the policy quo.

If the “blue wave” does materialize there is a strong case to made for rising yields, and in turn, the much-anticipated return to the down-trodden value sector.