Exxon Mobil Corp (NYSE:XOM) is set to declare its quarterly dividend on October 29, and while historically Exxon has been top-tier dividend paying stock, there is growing speculation the Texas-based giant will cut its current 87 cent quarterly dividend.

The graph below represents the cumulative returns of various sector ETFs and XOM in 2020, and it shows that while sectors such as tech (XLK), financials (XLF), and healthcare (XLV) have rebounded during the pandemic, energy (XLE) and XOM continue to struggle. While there appears to be a general consensus from analysts that Exxon will be forced into reducing its quarterly dividend in the face of low and uncertain oil demand, the question then becomes, how much of a dividend cut should we expect?

Source: OptionMetrics

Currently, the consensus among analysts is that Exxon will cut its dividend by about 50%, equating to an upcoming dividend of ~44 cents. While the majority of these analysts utilize balance sheets and income statement forecasts to generate their estimates, we employ a quantitative approach.

We utilize our proprietary pricing model and extract the embedded dividend expectations from options. Although this methodology is more sophisticated than the conventional put/call parity used to extract information from option prices, its ability to account for the early exercise feature of American style options yields more accurate and robust estimates compared to those of put/call parity.

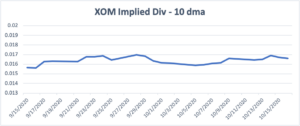

The graph below represents a 10-day rolling average of the XOM implied dividend yield generated from options expiring November 20, 2020. We use a rolling average to smooth out noise from varying bid/ask spreads. The implied dividend yield ranges between 1.55% – 1.7%, indicating the market appears to be expecting a dividend of approximately 50-55 cents, or a decrease of roughly 40%. In yield terms, the annual yield falls to nearly 6.5% from 10.5%.

Source: OptionMetrics

While this cut is slightly smaller than some on the street have predicted, option prices appear to agree with analysts that Exxon will likely cut dividends in the upcoming quarter.