Ongoing and increasing tensions between Russia and Ukraine are having a direct effect on European energy prices and, potentially, the implied volatilities and prices of certain European and US stocks in the energy, defense, and agricultural sectors.

Although not well publicized in the US, Europe has been undergoing a slow-motion energy crisis since last Fall. Natural gas and power prices in Europe were reaching unheard of levels even before the related political situation started heating up. The simple fact is that Russia supplies 35–40 percent of Europe’s natural gas. As long as that supply might be in question, and Europe continues to curtail supplies due to environmental concerns, Russia will have an inordinate effect on European energy prices. This gives Putin leverage beyond Russia’s military might, whether to achieve the reunification of Mother Russia, the approval of the Nord Stream 2 Pipeline, NATO containment, or all three. With more than $630 billion in reserves, Russia could likely withstand whatever sanctions the West could realistically put in place. If Russia follows through on its ultimate threat and invades Ukraine, the energy situation in Europe will accelerate into new levels of supply disruption, volatility, and uncertainty. This will not only directly affect natural gas, crude oil, power, and LNG but will also impact stocks in energy, defense, and agriculture (Russian and Ukraine are major suppliers of wheat and corn).

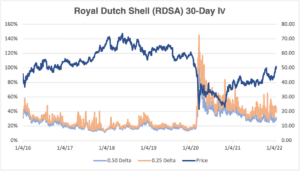

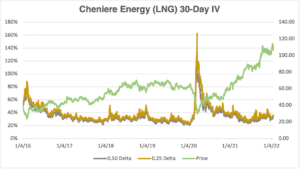

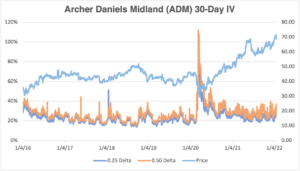

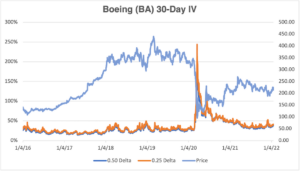

Consider the following energy, LNG, agricultural, and defense charts:

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

Although price levels have been broadly increasing (excepting BA), the implied volatilities of these stocks have not followed suit and remain firmly in their average trading band. Can we therefore conclude that their implied volatilities are undervalued? Based on the geopolitical situation, historical precedent, and current volatility levels, it appears so.

Since implied volatility tends to react the most to outside and unpredictable shocks, whether they be economic, geopolitical, or physical, a Russian invasion of Ukraine could have an outsized effect. In that case, front month options would likely display increased volatility, as well as ATM to OTM skew. Moreover, since the geopolitical situation will likely be slow to resolve, volatility levels could remain elevated for some time.

“Sticky to the downside,” as traders say, and there is ample historical precedent to back this up. The last time military hostilities weighed on the markets was during the Gulf Wars. During the prelude to both, volatility levels shot up in anticipation of hostilities, increased again when fighting began, and remained elevated for some time afterwards. Although not as significant internationally, a Russian invasion could have a similar effect, especially since the effects of a Russian invasion do not seem to be reflected in option prices – yet.

Brett Friedman is Managing Partner of Winhall Risk Analytics and an OptionMetrics content contributor