Meme stocks once again surged in popularity earlier this month. Their temporary comeback recently was led by Bed Bath & Beyond, a stock whose rise began with disclosure of a large position of call options by investor Ryan Cohen, of RC Ventures (and also co-founder of Chewy and Chairman of GameStop). BBBY’s stock price rose over 200% over several days from 08/04 to 08/17 as retail trades piled in.

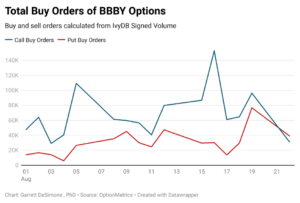

The implied volatility (IV) of BBBY (shown in graph 1) rose to near 300% on Aug 17th, its highest level on record. The IV is the options market estimate of the future fluctuations of a stock.

These IV levels, and BBBY’s price on 08/17 of $23.08, implied that the stock was likely to vary by plus or minus $19 over the next month (a significant swing with BBBY at under $5/share in late July)! High volatility levels indicate extremely expensive option premiums.

However, the excitement of BBBY washed out quickly, after it was disclosed major shareholder Ryan Cohen had sold his stake.

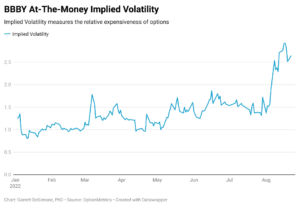

Perhaps the larger institutional investors had read the peaking volatility as an exit point for trades. Another indicator that the stock had lost momentum is the massive drop in purchased call contracts by investors between 08/16 and 08/17, pictured in graph 2. Purchased calls more than halved in size from 152k to 61k contracts during this time.

A crucial ingredient of meme stock rallies is the upward pressure placed on stock prices by the gamma effect. The gamma effect refers to market makers buying the underlying stock to maintain a delta neutral book. The sharp decrease in call buying on 08/17 coincided with a peak of $23.08.

This has spelled out doom for BBBY recently, with the stock recently taking a bath and dipping to $8.78 on August 23rd, as its lofty price was no longer supported by market maker purchasing.