The AI-fueled rally has propelled Nvidia to extraordinary gains this year. Among the large megacap tech stocks, which have collectively contributed to the resurgent S&P 500, Nvidia stands out as the sector leader, boasting a staggering 160% year-to-date gain. However, Nvidia’s distinctive position within the realm of megacap stocks exposes it to significantly higher systematic risks. OptionMetrics employs the concept of implied beta to assess forward-looking systematic risk based on a stock’s implied volatility and market implied covariance. This approach proves to be a much more accurate indicator than historical beta, as implied beta relies on option market expectations.

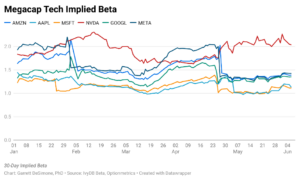

The graph below shows the 30-Day Implied Beta from IvyDB Beta, highlighting Nvidia’s position alongside other megacap leaders.

As we analyze the data more closely, a significant divergence in implied beta between Nvidia and its tech counterparts becomes apparent, particularly towards the end of April 2023. Notably this period aligns with major earnings announcements, which resulted in a decrease in volatility for most megacap stocks. However, in contrast to its peers, Nvidia (NVDA) experienced a distinct departure from this trend. While other tech names experienced a compression towards an implied beta of 1, Nvidia’s implied beta surged above 2. This indicates that the options market anticipates Nvidia’s daily moves to be amplified by more than double compared to the overall market. In contrast, the lower beta tech stocks exhibit daily returns similar to the broader market.

This divergence ultimately stems from Nvidia’s elevated exposure to broad macro risk factors compared to its AI peers. In simpler terms, negative news or adverse market conditions will have a more pronounced impact on Nvidia’s stock, magnifying the downside movement relative to the broader market represented by SPY. Our research also reveals that higher beta stocks tend to exhibit lower risk-adjusted compensation compared to lower beta securities due to overpricing resulting from leverage constraints.

Consequently, we anticipate that the AI boom may lead to a significant deviation in the return performance of megacap stocks, particularly Nvidia, in the future.

These findings emphasize the importance of carefully assessing the risk factors associated with stocks, such as Nvidia, and understanding the potential implications for investors seeking exposure to the AI sector.