The equity market continues to make new all-time highs, riding the back of an AI boom and lower interest rates. At the same time, it seems to be ignoring a steady stream of potential bad news – slowing employment, stubborn inflation, declining wages among lower and middle income workers, and continued economic policy uncertainty. Bull markets are said to “climb a wall of worry,” and this wall seems particularly steep.

Since many bearish or uncertain investors can’t seem to figure out why the market is behaving as it is, they conclude that it is acting irrationally, and therefore is either in, or forming, a financial bubble. These investors’ beliefs are supported and amplified by copious online commentary, some of it focused on why the “bubble” is about to burst. Whatever their logic, investors looking for a bubble in the equity market may be looking in the wrong place – gold could be a much more likely candidate, and below we look at gold options and other indicators for insight.

Gold has been rallying since mid-2023 and has been reaching consistent all-time highs since then. As of this writing, and since August 19th, the 30-day continuous futures contract has settled at new all-time highs for 10 out of the last 20 trading days. Gold is currently up almost 39% year-to-date. Silver has exhibited similar behavior, and may be poised to make a run at its 45 year-old all-time high of $49.45 (made in 1980 when the Hunt brothers attempted to corner the market – and failed). Even platinum, which has been picking up demand as a substitute of gold, is up over 55% year-to-date, making it the best performing commodity so far this year.

For many people, gold is the perfect investment at the perfect time. Since it thrives off fear and uncertainty – fear of inflation, currency debasement, debt, conflict, socioeconomic anxiety, etc. – gold is perfect for those looking for catastrophe insurance. It’s also gaining traction with newcomers from other markets who don’t normally dabble in gold but are attracted by its upward momentum. Social media is awash in breathless gold commentary, almost all of it bullish. According to Google Trends, worldwide search interest of the simple term “gold” on YouTube has increased over four times since the beginning of 2003.

Source: Google Trends

Adding to gold’s allure is continued, and consistent, economic and sociopolitical uncertainty. As measured by the Economic Policy Uncertainty Index, uncertainty has decreased from its all-time highs earlier in the year, but still remains at some of the highest levels ever recorded since 1900 (see chart below). That’s higher than during the Great Depression and World Wars One and Two. Even allowing for possible methodological errors or inconsistent data, that’s a shocking result. No wonder gold (and crypto) are so popular.

Source: Baker, Scott R., Bloom, Nick, and Davis, Steven J. (2016). “Measuring Economic Policy Uncertainty,” American Economic Review, 106(5): 1060-1100.

Not surprisingly, interest in gold-based ETFs has been exploding. For the last 10 years, ETFs represented 22% of total gold demand. For Q1 2025, it was 70%; for Q2, 56%. Apparently, retail investors are entering the space in a big way.

Interest in gold is certainly high, but that’s to be expected given its stellar price action over the last few years. However, it alone does not necessarily indicate that it’s in, or even forming, a bubble.

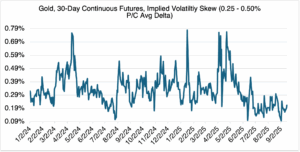

Gold options may provide some additional information. In a bubble, options skew, in this case the spread between out-of-the-money and at-the-money options, should increase as demand shifts to lower premium options with the chance for spectacular returns (“lottery tickets”). Below is a chart since the beginning of 2024 displaying the skew between 0.50 and 0.25 strike gold options:

Source: OptionMetrics

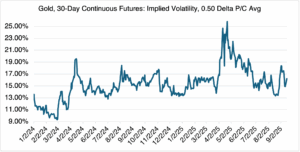

As you can see from above, the skew has not expanded and is not at unusual levels. Apparently, gold investors are not rushing into out-of-the-money strikes, as one might expect if a bubble were forming or present. And nor are they raising the absolute level of implied volatilty, as they would if they were anxious about increased uncertainty, or efficiently hedging their gamma risk. Gold implied volatilty is still running at relatively normal levels:

Source: OptionMetrics

Given the interest and the metrics reviewed above, is gold forming a bubble, or is it just in a justified and aggressive bull market?

Unfortunately, financial bubbles are notoriously difficult to identify and only reveal themselves with certainty in retrospect, not while they are occurring. At best, the characteristics of a bubble are highly subjective and sometimes depend on an individual’s particular experience and viewpoint. A “preponderance of evidence” test is the best we can do.

In this case, it seems likely that gold is not in a bubble just yet, but the signs are there that it might have the potential to form one. Its ever-increasing presence on social media, and the mainstream press, as well as the explosion in gold ETF activity, points in that direction. However, from an options point of view, the market itself does not seem to be exhibiting the highly volatile, frantic behavior that characterizes a genuine bubble. Instead, gold seems to be in an aggressive and consistent bull market. Financial bubbles do occur, but they are very rare. Unqualified assertions surrounding them should be treated with extreme skepticism.