Tesla (TSLA) stock has already experienced a significant decline in 2024, reaching new lows not seen since May 2023 and earning the title of the “worst-performing S&P 500 stock of the year” by some. TSLA’s steep drop has been accompanied by a barrage of negative news, including missed earnings, allegations of Elon Musk’s drug use, and downgrades.

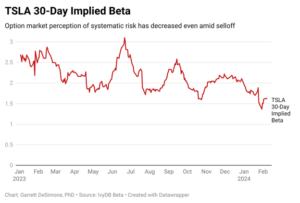

Given such pervasive pessimism surrounding the stock, one might expect its overall riskiness to increase. Interestingly, this hasn’t been the case, as indicated by TSLA’s implied beta. Implied beta measures the options market’s perception of a stock’s systematic risk, or its level of comovement with the aggregate market. High beta values indicate greater sensitivity to broad market movements.

In the chart below, the 30-Day implied beta of TSLA, from IvyDB Beta, is plotted starting from 2022. TSLA’s implied beta peaked at nearly 3 in June but has steadily declined to a present value of 1.6. This suggests that TSLA’s comovement with the SPY has decreased by nearly half. From a risk perspective, this indicates that the events surrounding TSLA have served to reduce its implied volatility and aggregate correlation. Almost paradoxically, TSLA’s poor performance is mitigating its systematic risk implied by option prices.

One possible explanation for the observed risk reduction is TSLA management’s noted slowdown in EV volume growth, with a focus on the development of its next-generation vehicle. A structural shift from a high-growth company ultimately lowers the stock’s systematic exposure. In other words, TSLA may be transforming into a relatively “safer” security, more insulated from macro and broad market risks compared to the past.

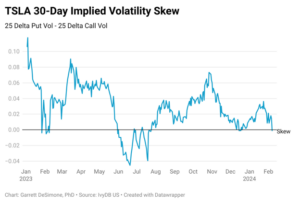

It is also worth noting that the market’s perception of downside risk hasn’t become overly negative. The chart below plots the 30-Day Implied Volatility Skew for TSLA, measured as the difference between 25 delta put volatility and 25 delta call volatility. Higher skew values signal relatively higher out-of-the-money (OTM) put prices, effectively indicating that the cost of downside hedging with options is relatively more expensive.

Surprisingly, the skew for TSLA is nearly 0, which signals balanced sentiment regarding the likelihood of upside versus downside stock swings.

Therefore, it is possible that TSLA’s decline may have already been factored into the stock price due to the negative news narrative. However, TSLA may not experience significant price jumps and growth like we have seen in the past, due to its lower market exposure.