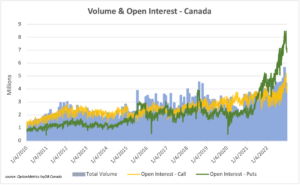

The Canadian options market has seen tremendous growth over the past decade, with both open interest and trading volume increasing substantially. In this article, we’ll take a closer look at the growth of the Canadian options market, using two charts to illustrate the trends.

The below chart shows the growth of open interest and total volume in Canadian exchange traded options from 2010 to 2023. Open Interest refers to the total number of outstanding option contracts on a particular security, whereas volume refers to the total number of option contracts that are traded during the month. As we can see from the chart, open interest and volume have steadily increased over the last decade. Between 2010 and 2022, the open interest and volume in Canadian exchange traded options experienced significant growth. In 2010, the combined open interest for calls and puts, as well as the total volume, was approximately 1 million contracts. However, by 2022, the open interest for calls and the total monthly volume exceeded 4 million contracts, while the open interest for puts grew even more, reaching nearly 8 million contracts.

This growth in open interest and total volume can be attributed to a number of factors. Firstly, there are more options listed on more securities, which has led to increased demand for options trading in Canada. The chart below displays the number of distinct exchange traded securities and option contracts, highlighting the growth of the equity and derivatives market in the last decade. Secondly, options have become more popular among retail investors who are looking for ways to hedge their investments or generate income from their portfolios. Finally, institutional investors are also increasingly using options as part of their investment strategies.

The Canadian equity and derivatives market has seen significant growth over the past decade, with both open interest and trading volume of exchange listed options growing significantly. As the market continues to grow, we can expect to see even more opportunities for investors to take advantage of the benefits of a liquid derivatives and equity market.

Abhinav Gupta is a Quantitative Researcher at OptionMetrics, an options database and analytics provider for institutional and retail investors and academic researchers that has covered every U.S. strike and expiration option on over 10,000 underlying stocks and indices since 1996. He draws on a Master of Science in Quantitative Modeling from Baruch College and a Bachelor of Science from Rutgers New Brunswick.