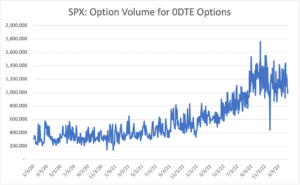

0DTE options are the latest novelty in derivative markets. These options are listed daily and expire at market close on the same day. Since their inception last year, the popularity of this product among investors has skyrocketed, peaking at over 1.7 million trades on October 13 alone (see Chart 1 below).

Source: OptionMetrics, IvyDB US

The surge in volume of 0DTE is somewhat uncharted territory. As such, there is a lack of consensus among strategists and financial economists on the potential impact of 0DTEs on market liquidity and volatility. Two groups of thought, include:

- One school of thought is that the presence of 0DTE acts as a volatility suppressor vis a vis the VIX. Since option demand is transferred to ultra-short dated options, the VIX level will systematically decrease. This is because the VIX calculation only accounts for options expiring between 27 and 37 days.

- Another is that 0DTE might trigger intraday market momentum with knock-on liquidity implications. Proponents of this theory point to the hedging activity of dealers buying en masse to neutralize their delta exposure. This would be volatility exacerbating. Here’s a more in depth discussion.

We are going to express dissent with the first point. The notion that the pure existence of 0DTE bounds volatility is a case of putting the cart before the horse. A condition for volatility suppression is end-users are net sellers of options. This is exactly what we find when we plot the net contracts traded in 0DTE (Chart 2).

Source: OptionMetrics, IvyDB Signed Volume

Net contracts are extracted as buy less sell orders from IvyDB Signed Volume. This chart indicates that beginning in June 2022, institutions have increasingly become net sellers of 0DTE, and short volatility. This finding is in alignment with the decreasing trend in volatility that has been witnessed throughout the duration of 2022. Institutional tilting towards selling ultra short-dated options is the mechanism by which vol is constrained. However, this selling environment will not last in perpetuity.

Here we can redirect our attention to the second point: institutional players have not exhibited a tendency towards net purchasing during the period of rapid expansion of 0DTE options. It is essential to underscore that the potential consequences of significant net buying on market liquidity remain unclear. Given the historical contagion effects of net structural buying in option buying in markets, it would be ill-advised to dismiss the impact of 0DTE as innocuous.