Industry research has empirically proven different types of calendar anomalies. Most scholars have a difficult time rationalizing these phenomena, and many even dismiss them. In this series, we look to elaborate on these anomalies in the equity market and extend them into the options market.

The most popular phenomenon is the day-of-the-week (DOW) effect, where research has proven that on average, returns on Mondays are lower than returns on other days of the week. There is an ongoing debate regarding why this anomaly exists. However, the most common explanation is a behavioral one; sleepy traders may be pessimistic during the start of the week and become more optimistic as Friday rolls around.

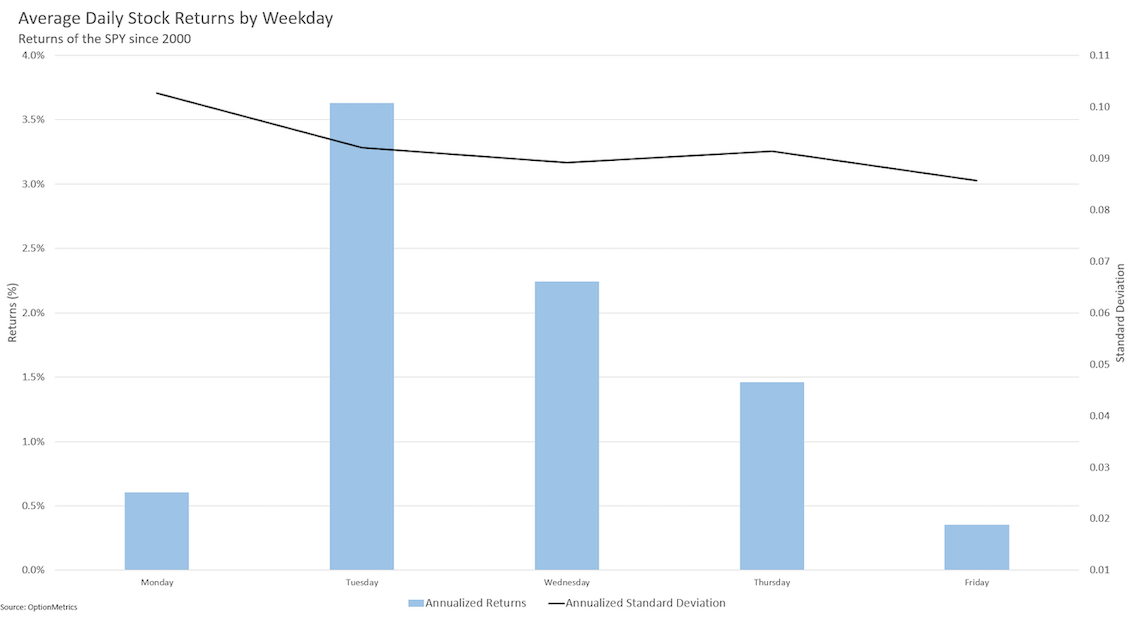

First, we aim to validate this phenomenon utilizing OptionMetrics flagship IvyDB US data, which contains data for all exchange traded equities and derivatives since 1996. We calculate the annualized returns and annualized standard deviation by weekday for SPY going back to 2000, which is illustrated below in graph 1.

The following provides evidence supporting the claim that Mondays generally have the lowest returns compared to the rest of the week. However, Fridays also exhibit low average returns, contradicting the claim of high returns as a result of weekend optimism.

This graph may also be used to highlight another interesting yet explainable phenomenon, the weekend effect. Monday’s returns (in Graph 1) have the highest level of standard deviation, making it the most volatile day of the week. This is primarily because all of the news and events that are released over the weekend are processed by investors and priced in on Monday.

Is the DOW effect applicable to the options market?

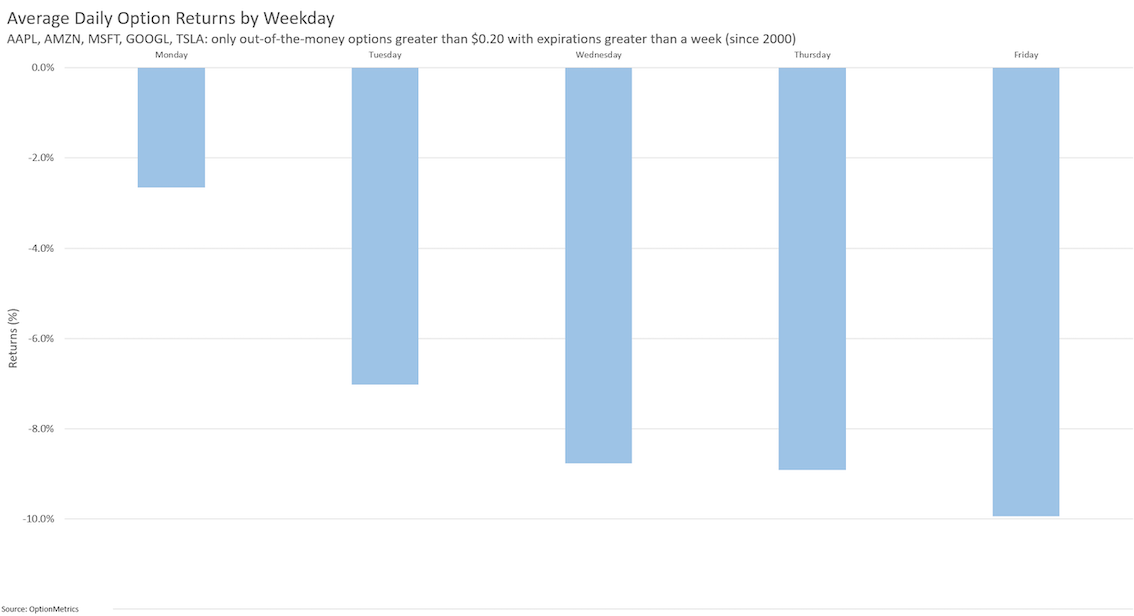

For our study, we focus on out-of-the-money options more than $0.20 with expirations greater than a week on Apple, Amazon, Microsoft, Google, and Tesla. Focusing on these liquid option chains eliminates illiquid and expiring options from our analysis, which can significantly skew return calculations. Graph 2, below, shows the average daily option returns.

Since the option returns consist of both calls and puts, the returns represent a strangle trade (long call and long put with the same expiration date). Strangle trades are long volatility, and due to the implied volatility risk premium, where implied volatility tends to be greater than realized volatility, returns tend to be negative.

The DOW effect looks to be the opposite for options, as returns on Monday are the highest. They gradually decrease over the course of the week, making Friday the day with the lowest returns, in the graph below. One possible reason is that volatility is the highest at the start of the week, as we saw in the previous graph. Strangle trades have higher returns when volatility increases.

Another potential reason for this effect is that traders may feel less confident holding options over the weekend, so the increased selling towards the end of the week causes returns to fall. To further validate this theory, we analyze the trend of open interest over the course of the week.

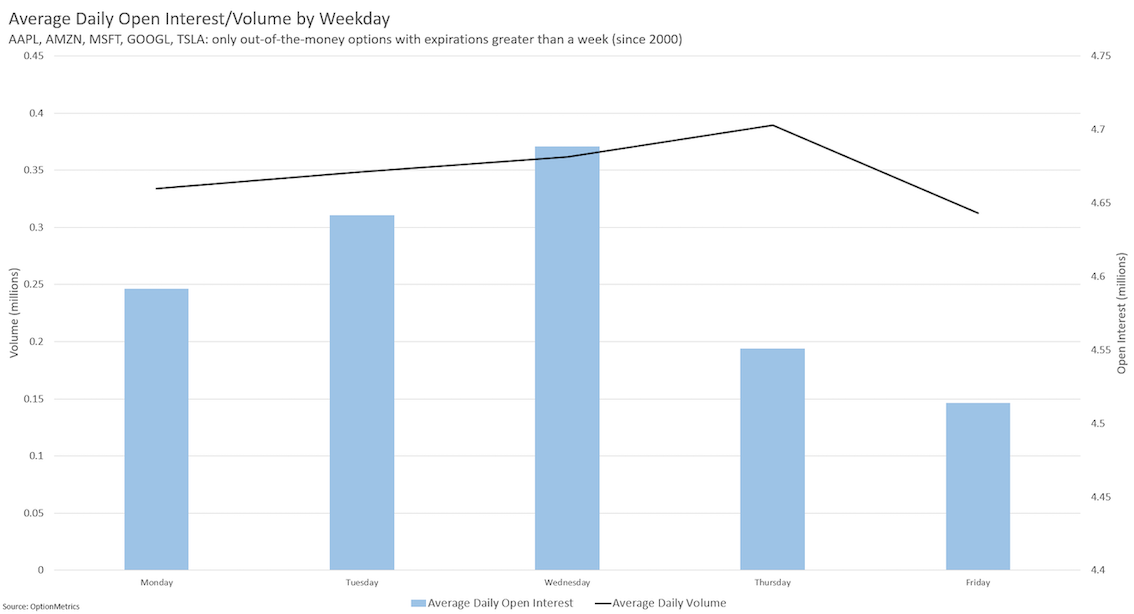

Graph 3, below, shows open interest steadily rising from Monday to Wednesday, followed by a sharp drop in the last two days of the week. This is accompanied by a steady increase in volume for the majority of the week, even on Thursdays, where the open interest drops significantly. A plausible explanation for this may be that most of the volume on Thursdays are sell orders as investors looking to close their positions before the weekend.

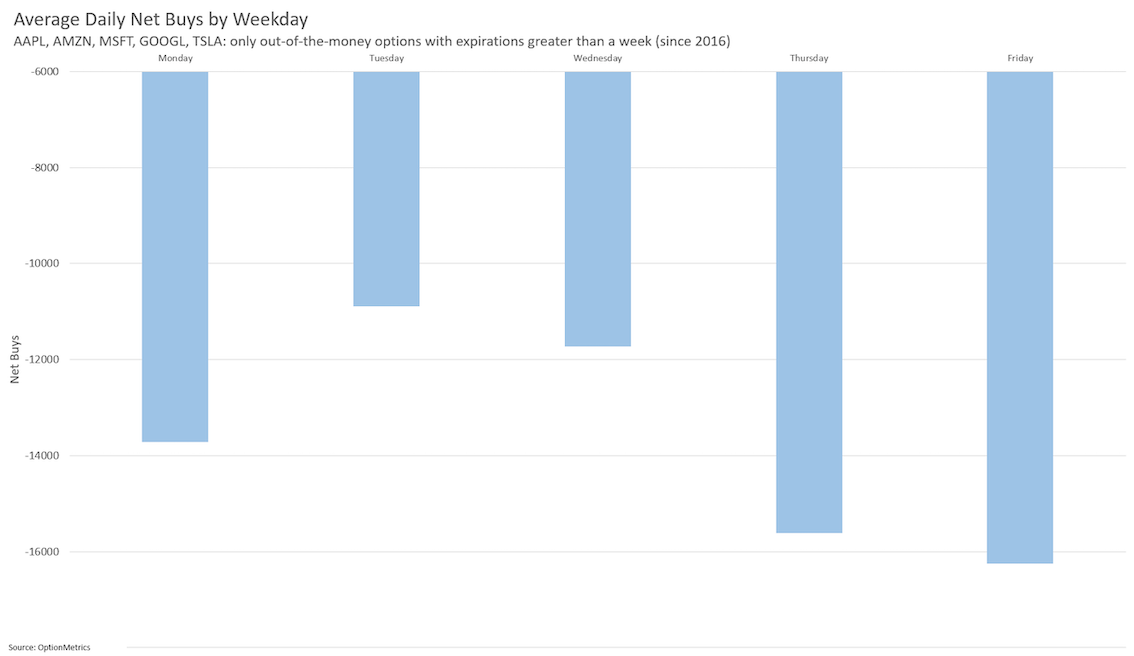

To verify the increased sell orders, we can utilize OptionMetrics’ Signed Volume product, which labels trades as either buyer or seller-initiated depending on where the trade executes in relation to the bid-ask spread. Trades executed at the ask price are labelled as purchases, and trades executed at the bid price are labelled as sells. This analysis indicates where there is systematic selling pressure towards the end of the week, leading to lower Open Interest and lower returns.

Graph 4 shows the net buys, or the difference between buys and sells of options, for each day. Net buys drop significantly in the later stages of the week. This downward selling pressure by investors is what causes option returns to fall later in the week.

As illustrated in the research above, the DOW effect seems to flip from the equity market to the options market. Monday returns are the lowest in the equity market, but highest in the options market. Options traders typically avoid holding contracts through the weekend, resulting in large seller-initiated option volume accompanied by a drop in open interest at the end of the week. As a result, it’s worth considering these anomalies when implementing equity or derivative trading strategies.