With inflation reaching above 4% recently, from rates of 2.6% about a year ago, anxieties regarding longer term inflation have entered the spotlight. The Fed’s easy-money policies and government stimulus spending had juiced growth and momentum into an epic bull run over the last year. However, these equity factors now face substantial risks from bond market volatility.

Often underappreciated, implied treasury volatility (TVOL) is a measure of uncertainty reflected in the options prices on 10-year yields. This implied volatility impounds all kinds of valuable economic information like inflation expectations, unemployment, and the direction of monetary policy.

Increases in TVOL are negatively related to aggregate market returns, as rate uncertainty causes equities to be riskier through the discount component of future cash flows. The graph below demonstrates the relationship between aggregate market returns and change in 10-year treasury volatility. All measures of TVOL are extracted from at-the-money futures options located on the OptionMetrics volatility surface.

It is evident that a rise in TVOL causes real headwinds for the broader equity market. However, we should not expect rate uncertainty to impact all stocks equally. Financial theory tells us sectors should have differing exposure to interest rate changes, namely growth and value. Growth stocks are anticipated to have larger cash flows in the future, therefore, rising rates should squeeze their valuations.

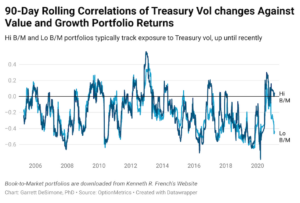

90-day rolling correlations are plotted for low Book-to-Market (B/M), or growth, and high B/M, or value, returns and TVOL changes in the next graph.

The sensitivities of growth and value to rates uncertainty track pretty closely to each other historically. However, growth and value exposures begin to diverge in a big way starting in 2021. While the high B/M portfolio has close to zero correlation to TVOL at the end of January, the low B/M stocks exhibit strong negative sensitivity near -0.5. Therefore, rises in TVOL impose much stronger losses on growth compared to value

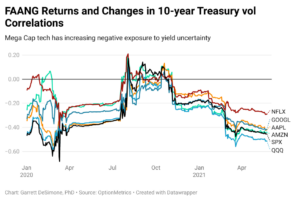

FAANG stocks (or the most prominent U.S. tech stocks: Facebook, Amazon, Apple, Netflix, Google) are now increasingly sensitive to inflation news with rising rates squeezing their valuations. This is likely to fuel volatility into mid-June upon release of important economic data. Critical dates for this sector are Non-Farm Payroll news on June 4th and Core CPI numbers on June 10th. These dates are ex-ante known periods of heightened risks for tech with higher-than-expected employment or CPI, that can cause continued inflation anxiety for investors.